While current U.S. tariffs were meant to level the global playing field, growing pains were always inevitable. Even global powerhouse General Motors, the country’s largest automaker, must contend with the trade war’s dramatic reverberations. In July, despite reporting revenue of $47.12 billion for the second quarter of 2025 – and beating Wall Street estimates of $46.28 billion – GM’s profits took a $1.1 billion hit. And it anticipates more going forward.

Although saying anything definitive about doing business globally is impossible due to the fluctuations of economics as politics, CEO Mary Barra delivered a strong, clear message in her letter to shareholders: GM is making adjustments to deal with the challenges. She wrote:

“In addition to our strong underlying operating performance, we are positioning the business for a profitable, long-term future as we adapt to new trade and tax policies, and a rapidly evolving tech landscape.

“For example, in June we announced $4 billion of new investment in our U.S. assembly plants to add 300,000 units of capacity for high margin light-duty pickups, full-size SUVs and crossovers. This will help us satisfy unmet customer demand, greatly reduce our tariff exposure, and capture upside opportunities as we launch new models. The capacity begins coming online in just 18 months, after which we project building more than 2 million vehicles in the U.S. each year as we scale.”

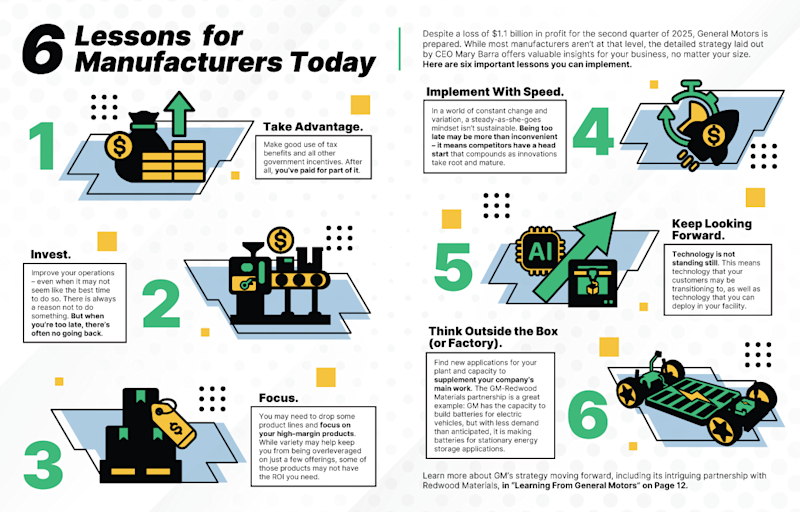

The company’s approach may be just what other U.S. manufacturers need to follow to succeed in current market conditions. Let’s break that down.

New Trade and Tax Policies

Again, there is flux in the trade arena at the moment, so trade and tax policies still need to be worked out. However, several advantageous tax policies for manufacturing companies were signed into law that immediately benefit companies, such as 100% bonus depreciation, doubling of the Section 179 expensing cap to $2.5 million, and more. See “Major Win for U.S. Manufacturers: One Big Beautiful Bill Signed Into Law” on ��ɫ��Ƶ Online for details.

$4B of New Investment

Ignore that (very big) number. Most companies don’t have $4 billion to invest. And, while your company likely doesn’t have a massive footprint in another country that needs to be reshored, elements of your supply chain could require an investment to relocate to maximize efficiency.

Two things are important to note about GM’s situation and consequent actions:

At the start of the year, Cox Automotive estimated total U.S. auto sales to be 16.3 million units for 2025; that has been lowered to 15.6 million, with 15.7 million being the baseline. Even with a declining market, GM is investing. The company announced its $4 billion investment on June 10. It could have invested less, or it could have put investing on hold entirely until there was greater clarity – but it saw the need to bolster its U.S. manufacturing footprint, and that costs money. Part of this investment will create capacity in two of its domestic plants to produce the gasoline-powered Chevrolet Equinox (Fairfax Assembly) and Chevrolet Blazer (Spring Hill Manufacturing), vehicles that are presently made at the company’s Ramos Arizpe plant in Mexico.

While this may seem obvious, the obvious always bears repeating: GM is focusing on its highest-margin products. This past June, in a presentation of Bank of America’s annual Car Wars analysis of the auto industry, the bank’s chief automotive analyst, John Murphy, said, “The next four-plus years will be the most uncertain and volatile time in product strategy ever. Therefore, we think that automakers must lean heavily into their core ICE product portfolios to generate the capital to fund the uncertain future.” This is precisely what GM is doing with its concentration on gasoline-powered pickups and full-size SUVs and crossovers.

Another portion of the $4 billion investment will go to the Orion Assembly plant in Michigan. Initially expected to produce electric trucks, the plant will now make large, gas-powered vehicles.

It is worth noting that on May 27, a few weeks before announcing its $4 billion investment, GM announced another manufacturing investment: $888 million for the Tonawanda Propulsion plant in Buffalo, New York – the largest single investment GM has ever made in an engine plant.

Here’s something worth noting about the Tonawanda plant: It was originally opened in 1938. By taking advantage of existing infrastructure, GM makes the most productive use of its money. This is not to say that it will use facilities that are nearly 90 years old, but that it is not going greenfield on its manufacturing operations, which can be cost-effective.

Tonawanda Propulsion currently makes the fifth-generation small-block V8. The investment will equip the plant to produce the sixth-generation version, which will be used in full-size trucks and SUVs.

So, while the media seems to pay considerable attention to EVs and think of V8 engines as relics of the 1960s, the folks doing the calculations at GM don’t think that’s the case.

Instead, GM is clearly leaning into what is making it the most money.

Online in Just 18 Months

One thing that can’t be overstated is the importance of being able to respond quickly to changing conditions.

GM builds light-duty pickups at a plant in Silao, Mexico – the Chevrolet Silverado 1500 and the GMC Sierra 1500. According to ProMexico Industry, GM was the top vehicle producer in Mexico in 2024, producing 889,072 vehicles – trucks and the aforementioned SUVs.

In addition to the plants in Silao and Ramos Arizpe, GM has another factory in San Luis Potosi. It also builds some Silverado 1500s at Oshawa Assembly in Ontario.

But it also builds the two trucks in Fort Wayne, Indiana.

What do Mexico and Canada have in common? When GM made the announcement, the U.S. neighbors faced 25% tariffs. Some adjustments can be calculated based on the USMCA trade agreement, but regardless, these are stiff tariffs.

So, GM will shift production from Mexico and Canada to Fort Wayne and the Orion Assembly plant, which will begin building trucks in early 2027.

Keep in mind that GM’s top competitor in the light-duty pickup space, Ford Motor Co., builds its F-150 in the United States at Dearborn Truck, Kansas City Assembly, and the Ford Rouge Electric Vehicle Center. The longer it takes GM to build its trucks in U.S. facilities, the more it will cost and the more market share it will lose to Ford, as Ford won’t need to increase prices to accommodate tariffs.

North Star

One more thing that can be gleaned from Barra’s letter to the shareholders – this one about technology.

She wrote:

“Despite slower EV industry growth, we believe the long-term future is profitable electric vehicle production, and this continues to be our north star. As we adjust to changing demand, we will prioritize our customers, brands, and a flexible manufacturing footprint, and leverage our domestic battery investments and other profit-improvement plans.”

According to Kelley Blue Book’s figures for the first half of 2025, 607,089 electric vehicles were sold in the United States – a 1.5% year-over-year increase and not the sort of thing that the domestic auto industry expected after investing billions of dollars in EVs.

GM, which is second to Tesla in EV sales in the United States, sold just 78,163 EVs in the first half of 2025 – and that’s from Cadillac, Chevrolet, and GMC.

To put the 78,163 figure in context: During the same period, GM delivered 129,889 gasoline-powered Chevy Equinoxes.

No, GM’s EV sales are not where they need to be to be a viable, contributing part of the company’s business. However, Barra is saying, in effect: Not yet.

GM will continue with the technology. Despite shifting plans – such as with the Orion Assembly plant – Barra emphasizes that the company believes “the long-term future is profitable electric vehicle production.”

In the meantime, GM will cleverly leverage its EV resources.

For example, it has established an agreement with Redwood Materials, which recycles, refines, and remanufactures lithium-ion batteries. In June, Redwood Materials established another business, Redwood Energy, to build low-cost energy storage systems for AI data centers. GM will manufacture batteries for Redwood Energy’s stationary energy systems and provide second-life battery packs from GM EVs – applying its production capacity to an entirely different field.

In announcing the Redwood agreement, Kurt Kelty, vice president of batteries, propulsion, and sustainability at GM, said:

“The market for grid-scale batteries and backup power isn’t just expanding, it’s becoming essential infrastructure.

“Electricity demand is climbing, and it’s only going to accelerate. To meet that challenge, the U.S. needs energy storage solutions that can be deployed quickly, economically, and made right here at home. GM batteries can play an integral role. We’re not just making better cars – we’re shaping the future of energy resilience.”

Coda

Back in the early 1990s, I participated in the Agile Manufacturing Enterprise Forum, which brought together people from more than 150 companies at the Iacocca Institute at Lehigh University. Participants ranged from Mars Candy to Boeing and Motorola to Texas Instruments. Our objective was to define how companies could be more capable in light of unpredictable, dynamic conditions. We recommended that manufacturers be able to rapidly reconfigure manufacturing operations (“online in just 18 months”) and establish partnerships.

Redwood Materials founder and CEO JB Straubel illustrates these points well: “Both GM’s second-life EV batteries and new batteries can be deployed in Redwood’s energy storage systems, delivering fast, flexible power solutions and strengthening America’s energy and manufacturing independence.”

After some 30 years, agility’s time, it seems, has come.

To read the rest of the International Issue of MT Magazine, click .