As trade policy continues to evolve, the U.S. manufacturing technology sector is feeling the sustained sting of tariffs – not just in higher costs but in strategic drift. ��ɫ��Ƶ – The Association For Manufacturing ��ɫ��Ƶ’s Tariff Impacts on Manufacturing ��ɫ��Ƶ: 2025 Q3 Spot Survey of 80 manufacturing tech executives underscores a hard truth: Tariffs are reshaping everything from pricing and sourcing to investment timelines. Manufacturing companies are looking for more direction and support.

Complex Web of Tariffs Impacting Cost and Compliance

What began in 2018 as targeted duties has, by 2025, expanded into a layered system of tariffs that now reaches into most segments of the manufacturing technology supply chain.

Key measures currently affecting the sector include:

Reciprocal tariffs: A two-tier system adding a 10% base rate on most imports, plus higher surcharges on nations with major trade deficits.

Section 301 tariffs: Ongoing duties on imports from China, originally introduced to address unfair trade practices.

Section 232 steel and aluminum tariffs: Expanded in 2025 to 50%, now reaching derivative products such as machining centers and precision parts.

Pending 232 investigation: A new review of robotics and industrial machinery imports that could bring additional restrictions before year-end. are due by Oct. 17, 2025.

Each layer adds complexity to pricing, sourcing, and production planning for manufacturers across the supply chain.

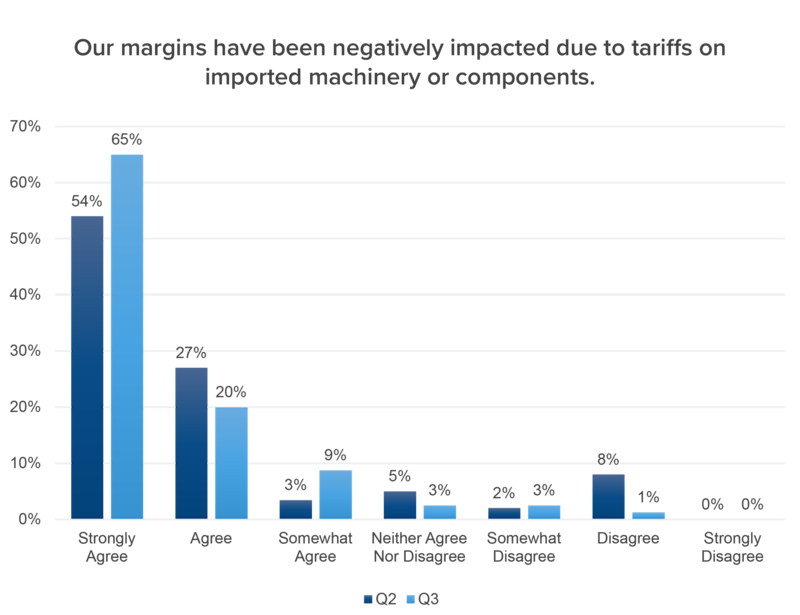

Rising Costs and Shrinking Margins

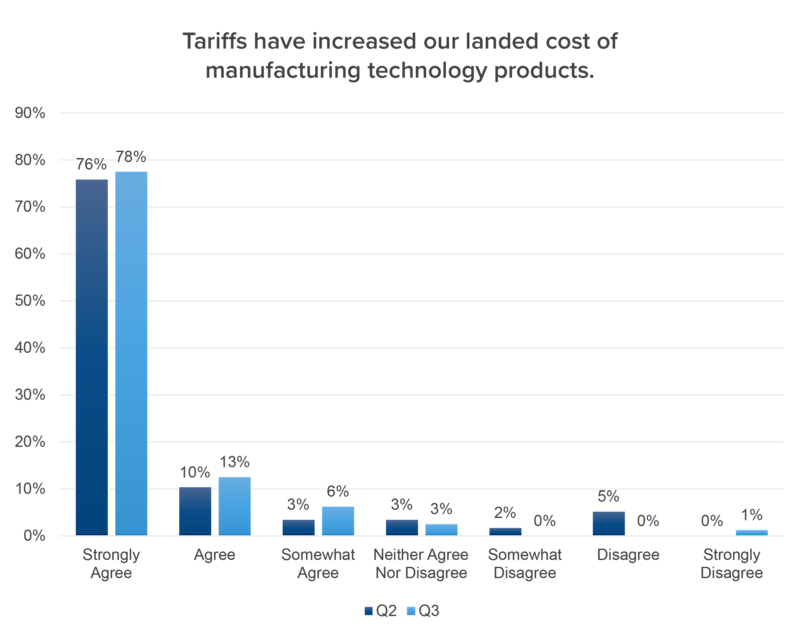

Manufacturers continue to absorb direct cost shocks from tariffs on machinery and components. According to the survey:

91% report increased landed costs due to tariffs.

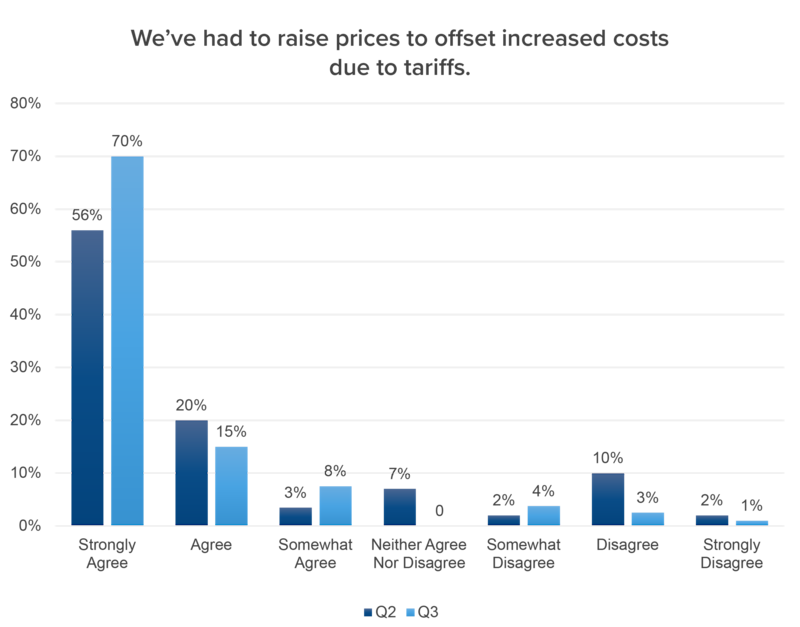

85% say they’ve raised customer prices to offset those costs.

85% report margin compression on imported goods.

While some firms pass these costs through to customers, others are caught in a competitive bind, forced to absorb the losses or restructure their offerings. This pricing volatility isn’t just affecting P&L sheets – it’s damaging long-term customer relationships and trust.

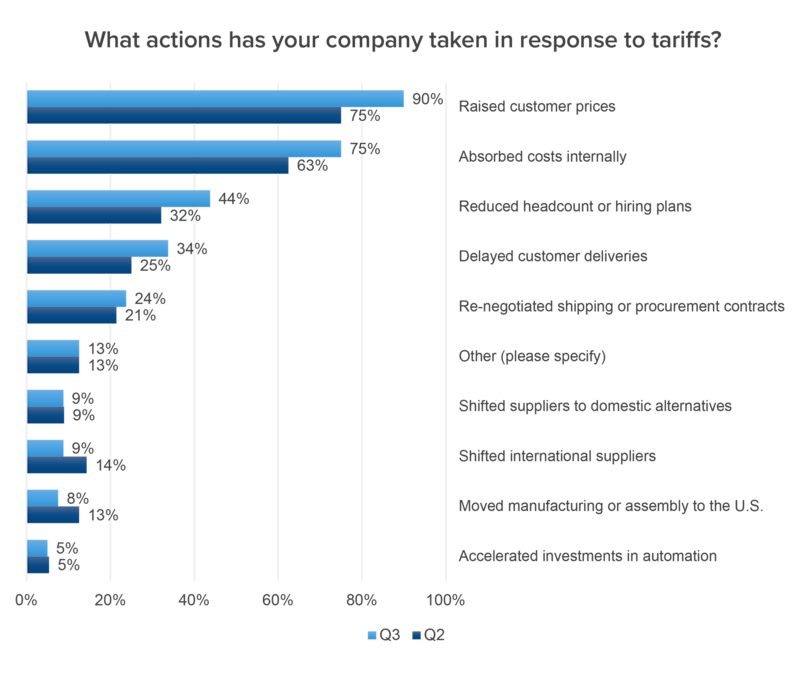

Strategic Responses: Shallow Shifts, Little Reshoring

Despite pressure, most firms are not making deep structural changes. Cost pass-through remains the dominant tactic, while reshoring, automation, or sourcing diversification trail far behind.

90% are raising prices.

75% are absorbing some tariff costs.

Only 9% report shifting suppliers.

The data suggests a sector still in reactive mode, lacking the policy certainty, incentives, and supply chain agility needed for proactive adaptation.

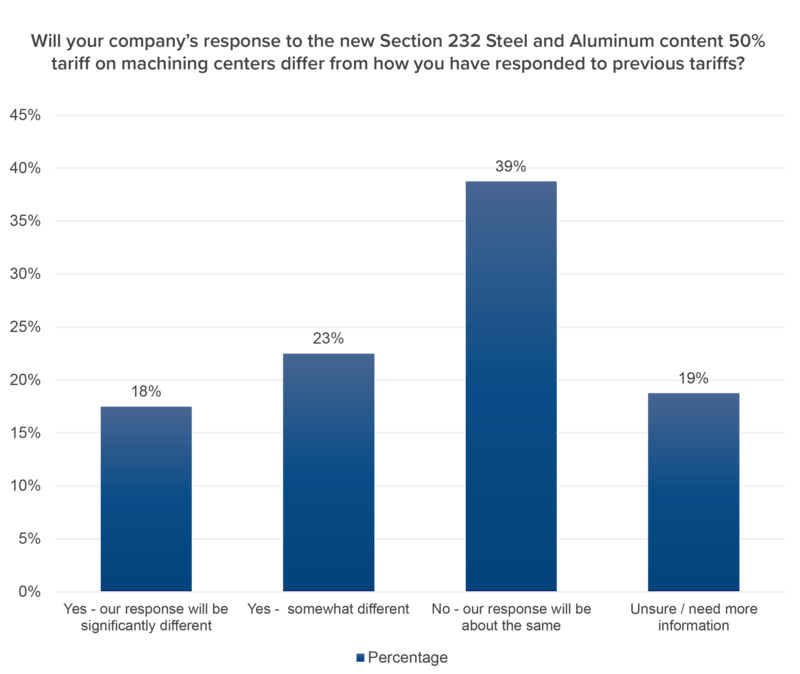

Response to New Tariffs: Repeating the Same Playbook

When asked about the new 50% tariff on machining centers under Section 232, most firms say they’ll respond the same way as before – absorb or pass on the costs. Few see this as a trigger to rethink sourcing or production strategies.

This suggests tariff fatigue: Companies are worn down by unpredictability, unsure whether to commit to major changes or wait for clearer signals. As one respondent put it: “We want to move more production here – but there’s no roadmap or incentive structure to make it viable.”

What Manufacturers Are Asking For

The call from industry leaders is clear:

Greater transparency in trade policy

Predictable enforcement timelines

Early warning on tariff changes

Investment incentives for domestic production

Support for supplier diversification and workforce readiness

Tariffs are reshaping how manufacturers plan, invest, and compete – with consequences that extend well beyond the balance sheet. To dive deeper into the data and insights from our Q3 survey, including in-depth quotes from the ��ɫ��Ƶ leader community, we encourage you to download the full report. To stay connected with the latest trade developments, policy updates, and industry research, subscribe to ��ɫ��Ƶ NOW, our member newsletter.

Want the Full Report?

Download the full findings of .