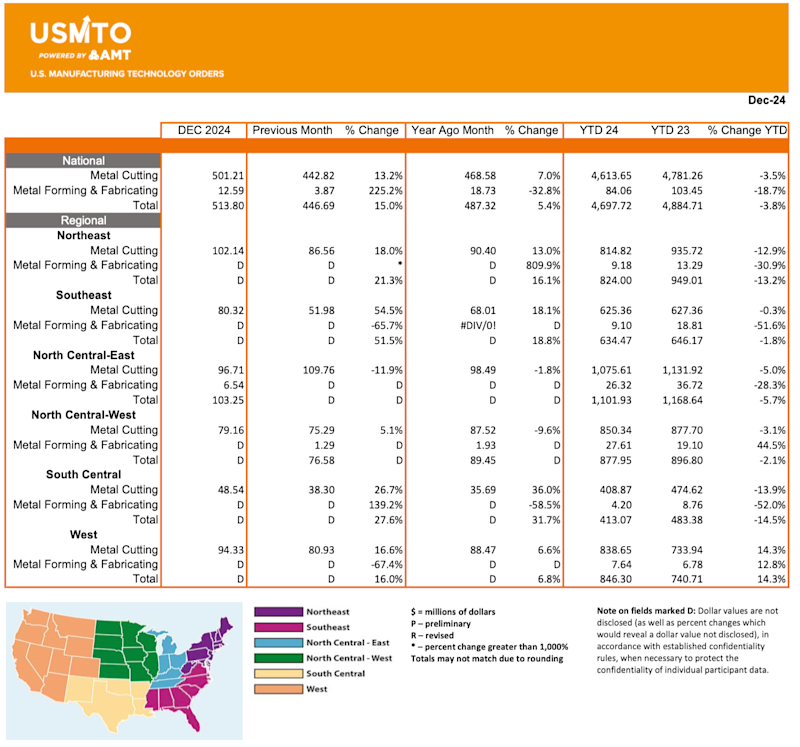

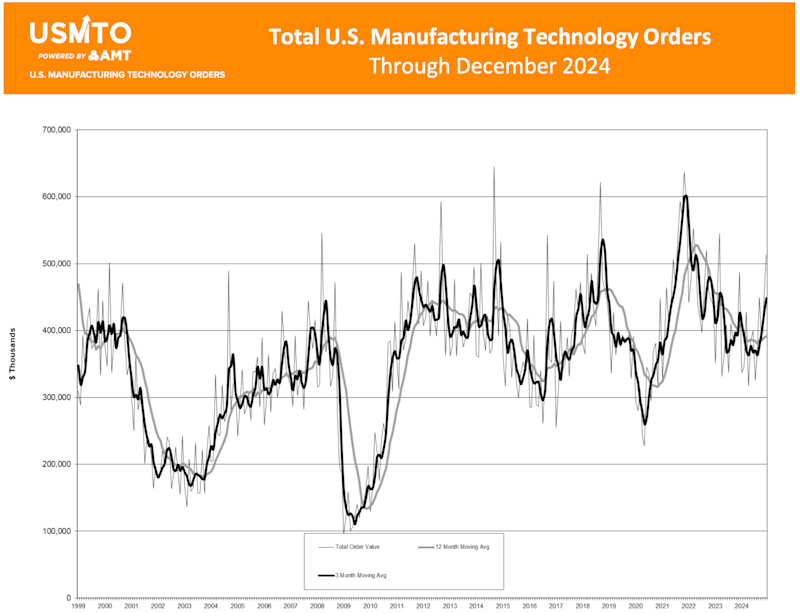

McLean, Va. (February 10, 2025) — Orders of manufacturing technology, measured by the U.S. Manufacturing ��ɫ��Ƶ Orders (USMTO) report published by ��ɫ��Ƶ – The Association For Manufacturing ��ɫ��Ƶ, totaled $513.8 million in December 2024, the highest level since March 2023. These orders for metalworking machinery increased 15% from November 2024 and were 5.4% above December 2023. Year-to-date orders reached $4.7 billion, a decline of 3.8% compared to orders placed in 2023.

For the third consecutive year, machinery orders have declined. However, orders in 2024 were 9.7% above the annual average dating back to 1998, indicating that demand is resilient for machinery despite these declines. After a slow start to 2024, orders of manufacturing technology remained elevated following September’s . Although orders in September were modest compared to a typical IMTS year, the falloff in demand typically seen after the show did not happen, and 2024 ended in a strong position.

Orders from contract machine shops, the largest consumer of manufacturing technology, were a drag on the overall market in the beginning of 2024. That turned around toward the end of the year, when orders from this segment slightly outperformed the market, declining only 3.7% compared to 2023. Despite a , orders of manufacturing technology from the aerospace sector has increased significantly as the sector deals with . December 2024 saw the highest order volume from this sector since December 2021, and total orders through the year increased nearly 32% from 2023. After three years of heightened investment, automotive manufacturers pulled back orders in 2024 by a quarter as demand for vehicles normalized and the industry braced for the potential impact of tariffs.

Nearly 40% of all orders in 2024 were placed since IMTS in September. This points to sustained demand for machinery heading into 2025. Through January 2025, quotation activity remained elevated, but the time between initial quotation and order was longer than usual. Forecasts presented at show promising signs for 2025, assuming geopolitical and trade disruptions are minimal.

# # #

The United States Manufacturing ��ɫ��Ƶ Orders (USMTO) Report is based on the totals of actual data reported by companies participating in the USMTO program. This report, compiled by ��ɫ��Ƶ – The Association For Manufacturing ��ɫ��Ƶ, provides regional and national U.S. orders data of domestic and imported machine tools and related equipment. Analysis of manufacturing technology orders provides a reliable leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity. .

��ɫ��Ƶ – The Association For Manufacturing ��ɫ��Ƶ represents U.S.-based providers of manufacturing technology – the advanced machinery, devices, and digital equipment that U.S. manufacturing relies on to be productive, innovative, and competitive. Located in McLean, Virginia, near the nation’s capital, ��ɫ��Ƶ acts as the industry’s voice to speed the pace of innovation, increase global competitiveness, and develop manufacturing’s advanced workforce of tomorrow. With extensive expertise in industry data and intelligence, as well as a full complement of international business operations, ��ɫ��Ƶ offers its members an unparalleled level of support. ��ɫ��Ƶ also produces IMTS – The International Manufacturing ��ɫ��Ƶ Show, the premier manufacturing technology event in North America. ��ɫ��Ƶonline.org.

IMTS – The International Manufacturing ��ɫ��Ƶ Show is where the creators, builders, sellers, and drivers of manufacturing technology come to connect and be inspired. Attendees discover advanced manufacturing solutions that include innovations in CNC machining, automation, robotics, additive, software, inspection, and transformative digital technologies that drive our future forward. Powered by ��ɫ��Ƶ – The Association For Manufacturing ��ɫ��Ƶ, IMTS is the largest manufacturing technology show and marketplace in the Western Hemisphere. With more than 1.2 million square feet of exhibit space, the show attracts visitors from more than 110 countries. IMTS 2024 had 89,020 registrants, featured 1,737 exhibiting companies, and included a Student Summit that attracted 14,713 visitors. Be the change at IMTS 2026, Sept. 14-20, 2026. Inspiring the Extraordinary. .